Harness the Power of Merchant Category Codes to Control Business Spending

by Jillian Straw

Whether you’re a business owner or a member of an accounting team, it can cause a lot of stress to hand over petty cash or company credit cards to employees. Cash is extremely difficult to track, and even if spenders get receipts for purchases, it may not account for all of the physical bills they took in the first place. With credit cards, every transaction is traceable, but you usually can’t dictate exactly how much can be spent in a single purchase.

It’s not that you don’t inherently trust who has cash in their hands—you’re just savvy enough to know that your money may be misused. After all, it’s critical to manage spending in any type of business.

What if we told you that we could erase your spend-related stress by putting some guardrails around what you thought couldn’t be controlled? All you need to do is harness the power of Merchant Category Codes with The Ottimate Card.

Before we get too ahead of ourselves, let’s explore exactly what these codes are and why they exist in the first place.

The Ottimate Card is a corporate debit card program and spend management platform that lets every business and every employee leverage pre-approved spend control. To learn more, click here.

What is a Merchant Category Code?

A Merchant Category Code (MCC) is a four-digit number assigned by financial institutions that categorizes a business based on its products or services. Hotels might share the same MCC, but restaurants may have more specific codes based on their business model. For example, Starbucks will have a different MCC than your local Olive Garden.

Businesses that generate over $10 million in annual revenue qualify for their own MCCs, so they might not have the same MCC as the rest of its peers. Consider Delta and Southwest: both are airlines, but they each have their own MCC.

If you’re surprised you haven’t encountered MCCs, you just haven’t been looking closely enough. When you log on to read a credit card statement, you usually see Categories that show you how each transaction is classified. This is a simplified, user-friendly way of telling you what the MCC is for each purchase.

Why Merchant Category Codes matter

The Internal Revenue Service (IRS) enacted MCC requirements in July 2004. These guidelines were put in place to simplify year-end reporting on 1099 tax forms, offering businesses clarity around what could and could not be classified as reportable expenses.

The International Organization for Standardization (ISO) is responsible for creating all MCCs and their definitions. These standards are updated every 5 years. However, it’s the credit card processors that assign MCCs to individual businesses.

Businesses are assigned MCCs either as they apply for a corporate card or as soon as they begin processing payments. The MCC determines how much in credit card processing fees you’ll pay, depending on the risk inherent in your specialty—so travel-related MCCs are associated with higher processing fees than food-related MCCs.

But MCCs are important for consumers, too. These are the codes that determine exactly how many credit card points you or your company can rack up on any given purchase. Buyers can even look up specific merchant codes before a purchase is made to ensure points will be allocated correctly.

Rein in business spending with Merchant Category Codes

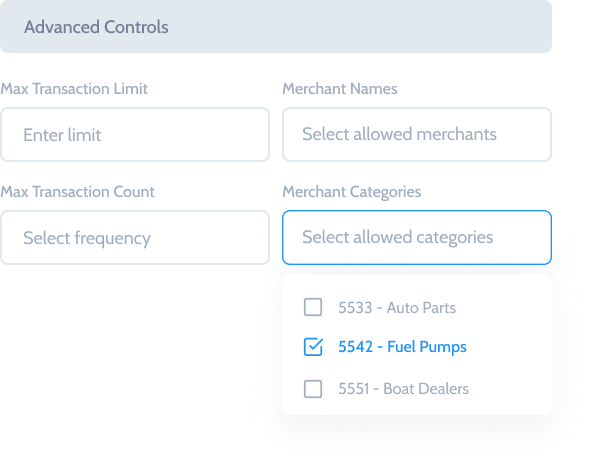

With The Ottimate Card, businesses can not only create cards for specific employees and specific merchants, but also specific MCCs. No more worrying how much is going to get spent and on what—you have the power to set swim lanes before any employee gets card access, all thanks to the codes that all businesses already have.

We service several business types within the hospitality industry, so let’s take a look about how this can work in practice based on our core customer types.

Example 1: Your restaurant runs out of a key ingredient

Restaurant owners and operators are probably all-too familiar with this scenario. Preparing for a dinner rush, your vendor order arrives and a key part of your order is either missing or unusable. You have no desire to 86 half of your menu for the evening, so you send an employee to the nearest grocery store to pick up what you need for service.

Usually, this employee would get petty cash, and you’d ask for the receipt and change upon their return, hoping for the best. But with The Ottimate card, you can have a physical copy on hand that can only be used at retailers with the MCC of 5411: grocery stores.

There’s no longer a need to track cash, nor do you need to worry if an extra buck or two was taken out for a snack. The full transaction is digitally documented, and the parameters of where employees can actually shop are strict.

Example 2: Your hotel’s linens desperately need to be cleaned

It’s an unfortunate reality: utilities may go out at your place of business without rhyme or reason. But somewhere like a hotel, where clean sheets and towels are table stakes for operation, you can’t wait for the electric outlets in your laundry room to get fixed. You need clean linens, and you need them now.

Your maintenance manager is well-connected and knows a local linen cleaning service that services other hotels in the area. Ordinarily, this might give you pause; the maintenance manager might be trying to give their cleaning connection a sweeter price for the service than what they’d usually charge a business of your size.

With the Ottimate card, you can ask the cleaning company for what they’ll charge up front—then assign a card to your maintenance manager that not only is specific to the MCC for the cleaning service, but also specific to the amount you were quoted. No kickbacks, no worries.

Example 3: Your country club needs to fuel its fleet of golf carts

You’ve been wanting to upgrade your golf carts to electric for ages. But you’re currently still running on gas. And on a busy Sunday afternoon at the country club, you want nothing more than battery-operated carts when you realize the high school kid who’s supposed to fuel everything up at the end of their Saturday shift left the carts empty.

Trying to get ahead of a backup at the clubhouse, you grab the first employee you see and ask them to head to the gas station to fill up enough cans to get you through the rest of the day. But gas stations also sell snacks, booze, and cigarettes—and handing over any old credit card could be like giving a blank check to someone who sees a gold mine.

What if you had a card that could only be used for gas? It’s a reality with The Ottimate Card. All you have to do is issue a physical card that can only be used on purchases with an MCC for 5542: fuel pumps.

Control business spend better with The Ottimate Card

No matter what type of hospitality business you run or manage, The Ottimate Card lets you determine exactly how your money can be spent. Small charges that aren’t directly related to business expenses can quickly add up over the course of a month, so assigning MCC codes to your corporate cards helps eliminate unnecessary purchases and grow more profits.

The Ottimate Card features much more than just MCC code control. Learn about the many ways our product can reduce risk and give you unparalleled spending insights by requesting a demo with a Ottimate specialist below.

Stay up to date on the latest news in AP automation and finance

Related